Introduction: A New Era for Crypto Cycles

Since 2021, crypto markets have entered a fundamentally new phase shaped by institutional investors, regulatory clarity, market manipulation by large players, and increasing correlation with traditional financial markets. Unlike the earlier years, where Bitcoin followed a predictable 4-year halving cycle, the market has now shifted into a multi-cycle structure, similar to the stock market.

In this article, we break down the four-year crypto cycle from 2022 to 2026, explain Major, Mini, and Mega Bull Runs, identify Mini and Traditional Bear Markets, and explore how institutional behavior has changed market patterns.

This is personal research based on fundamental market shifts and observable technical cycles.

Always do your own research. This is not financial advice.

🔵 Why Crypto No Longer Behaves Like the Old Cycles

Traditionally:

- Bitcoin halving → one big bull run

- Followed by a long bear market

- Repeat every 4 years

But the entry of:

- Institutional investors

- Big funds

- ETFs

- Stock market players

- Political influences including Trump era

…has completely changed the dynamics.

Now, crypto behaves more like stock markets, where:

👉 A 20% drop can be treated as a bear phase

👉 Markets create multiple mini-cycles

👉 Long predictable cycles no longer exist

🟢 The New 4-Year Crypto Structure (2022–2026)

Crypto now shows:

✔ 1 Traditional Major Bull Run

✔ 3 Mini Bull Runs

✔ 3 Mini Bear Markets

✔ 1 Traditional Big Bear Market

These eight phases complete the full cycle.

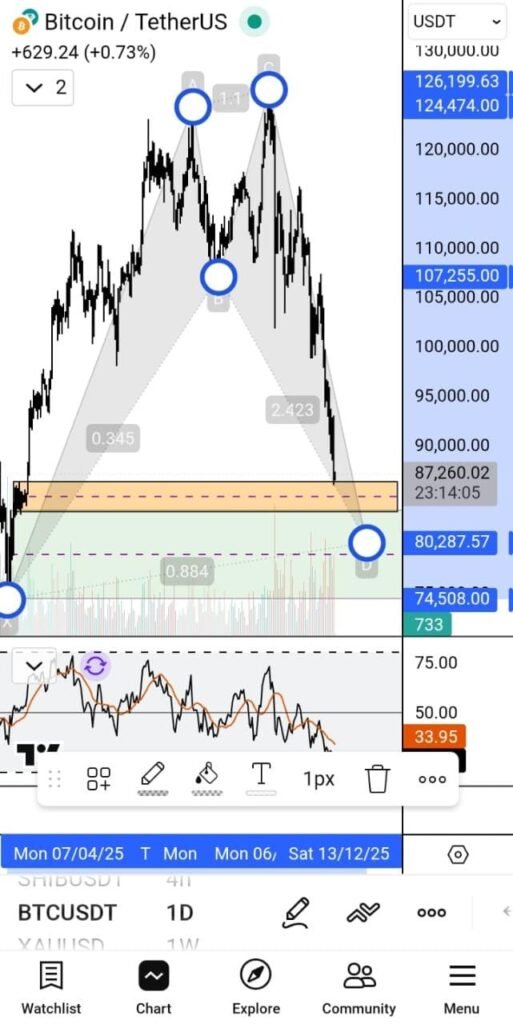

📈 Bitcoin’s Journey (15k → 126k): Cycle Breakdown

Let’s count the actual cycles from 2022 to 2025:

🟣 1. Major Bull Run (15k → 73k)

This was the first and strongest expansion phase, driven almost entirely by Bitcoin.

- No altcoin rally

- ETF narrative started building

- Market regained confidence post-FTX collapse

This is the only Major Bull Run of this cycle.

🟡 2. Mini Bull Run (49k → 109k)

This was again Bitcoin-dominant.

- BTC ETFs made the biggest impact

- Institutions accumulated heavily

- Altcoins remained suppressed

Again → Altcoin season did NOT start.

🟢 3. Mini Bull Run (74k → 126k)

This time:

- Bitcoin pumped

- Ethereum followed

- Big-cap altcoins like SOL, AVAX, LINK also moved

But this still wasn’t a true altseason or “mega bull run.”

🔥 4. Mega Bull Run (80k → 138k) (Expected Feb 2026)

This will be the real & full altseason of this 4-year cycle.

Mega Bull Run Features:

- Explosive altcoin growth

- Retail FOMO

- Highest liquidity inflow

- Market-wide mania phase

- BTC target ≈ 138k (plus/minus deviation possible)

This is the final bullish phase before the big traditional bear market.

🔻 Mini Bear Markets (Three Already Happened)

The three mini down-cycles were:

- 73k → 49k

- 109k → 74k

- 126k → 80k

Each was:

- Short

- Shallow

- Not a full bear market

- Mostly used for institutional accumulation

Only one big traditional bear market remains.

🔴 Final Traditional Bear Market (138k → 48k)

Timeframe: March 2026 → End of 2026

This will be:

- Deep correction

- Multi-month downtrend

- Complete cycle reset

- Entry point for next 4-year accumulation phase

This is similar to stocks, where a 20%+ market fall signals a bear phase.

🔍 Why Markets Behave This Way Now

1. Institutional Involvement

Crypto is no longer retail-driven.

Big players now design the cycles with high precision.

2. ETF Flows

Billions in liquidity changes volatility structure.

3. Correlation With Stock Market

S&P 500 influence is stronger than ever.

4. Political Influence

Donald Trump and his sons openly endorse crypto projects and crypto-friendly regulations.

Market reacts strongly to political statements.

5. New Technical Chart Behavior

Patterns changed due to machine-driven high volume trading.

🧠 What This Means for Traders & Investors

Old Strategy

- Buy after halving

- Hold

- Sell at next peak

New Strategy

Profit comes from Mini Cycles.

You must identify:

- Mini bull runs

- Mini bear markets

- Institutional accumulation phases

Because long straight-up bull runs no longer exist.

📌 Summary of the Complete 2022–2026 Cycle

| Phase Type | Count | Key Levels |

|---|---|---|

| Major Bull Run | 1 | 15k → 73k |

| Mini Bull Runs | 3 | 49k → 109k → 126k |

| Mega Bull Run | 1 | 80k → 138k |

| Mini Bear Markets | 3 | 73k → 49k, 109k → 74k, 126k → 80k |

| Traditional Bear Market | 1 | 138k → 48k |

⚠ Disclaimer

This article is based on personal research and fundamental market observations.

It is not financial advice.

Always perform your own research.

- crypto market cycle 2026

- bitcoin mega bull run

- mini bull run crypto

- institutional crypto adoption

- bitcoin 138k prediction

- altseason 2026

- new crypto market structure

- crypto bear market timeline

- bitcoin cycles explained